Sign up now

Sign up now

Join the waiting list to be notified when Tax Happy is launched.

What is Tax Happy?

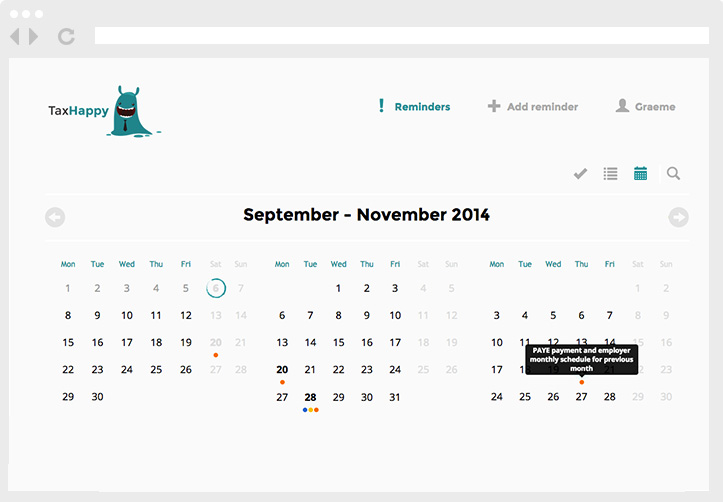

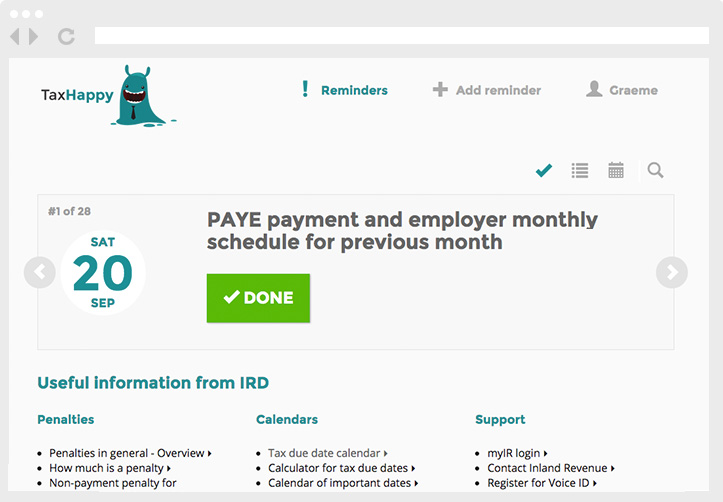

Tax happy is a compliance activity reminder system for businesses. It will store filing and due dates for compliance activities for up to four business entities. You can be reminded of these activities 4 times before the due date, so you can't forget or be distracted away from them. Compliance matters and Tax Happy will put in front of you what you need to do next.

Who is Tax Happy designed for?

You are an individual that represents one or a number of small to medium enterprises (SME). You are likely to be registered for GST and may also be an employer. If any of these statements are true for you then Tax Happy can make your life easier. You;

- are confident and self-manage your compliance but need reliable access to consistent information.

- can complete tax compliance work yourself, but prefer to delegate this role to others.

- need certainty of when and what taxes need to be paid and that you are doing the right things.

- just want to get tax done, and value having a friend or professional you can trust to keep at you.

Why was Tax Happy created?

To simply remind you of compliance dates. The 600,000+ SMEs in New Zealand all have compliance commitments. Generally these relate to tax payments but some are filing documents like Annual Returns. A single business that is GST registered and employs could have around 25 due dates to make annually. This is hard enough on its own, but if you own multiple businesses the work increases exponentially.

Some statistics

If you think you are alone or feel overwhelmed at meeting your many compliance dates, pause and reflect on this:

- Over 10% of GST and PAYE returns are filed late.

- Over 30% of business customers get their tax returns in late.

- Tax Happy was created to address a single problem of remembering compliance dates.

When to use to Tax Happy?

Tax Happy helps a business focus on the next 3 important dates. It's that simple. When an activity has been completed it is checked off and recorded as done. So easy, and so little effort. Penalties and interest that accumulate if you miss your compliance dates can be significant. It's easier and takes less effort meeting a payment or filing date than having to deal with being overdue.

How much will Tax Happy cost?

Tax Happy is free of fees. We'd like to keep it this way, but we do need to pay our bills. We intend to present a brief monthly questionnaire to you, asking you about your business experiences. It will be short, only monthly and its completion is the only requirement we have of you. This information will be presented in summary form to organisations that need to better understand how businesses work.

Sign up now, it's free!

Join the waiting list to be notified when Tax Happy is launched.